As the effective date of January 1, 2018 draws near, many businesses have initiated the process of analyzing the effects of the new revenue recognition standard, IFRS 15: Revenue from Contracts with Customers. However, only a few have taken the next critical steps of diving deep and implementing the new standard requirements. While the overall principles in IFRS 15 may sound familiar, the devil is in the details. The new standard introduces a significant amount of guidance and many new concepts on revenue recognition, cost recognition and requires significant disclosures.

While the impact of the changes brought about by the new standard will vary from industry to industry and from business to business, it is evident that the new standard introduces some significant changes in accounting for revenue. Businesses need to approach the new standard as a critical implementation/conversion project, and determine entity specific impact to contracts, accounting processes and procedures, controls, accounting systems, KPIs, compensation and bonus plans, loan covenants, operations, and sales processes among other issues.

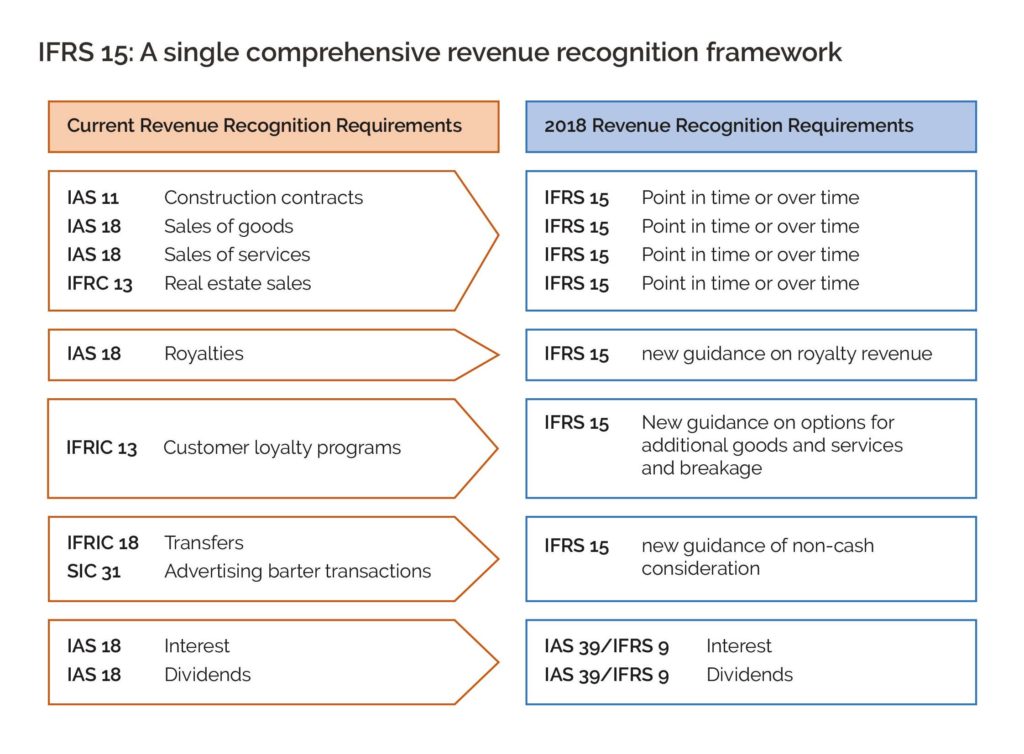

IFRS 15 provides a single comprehensive framework to be used by businesses to recognize revenue with customers. Six current revenue recognition guidance including IAS 11: Construction Contracts and IAS 18: Revenue, will be superseded by IFRS 15.

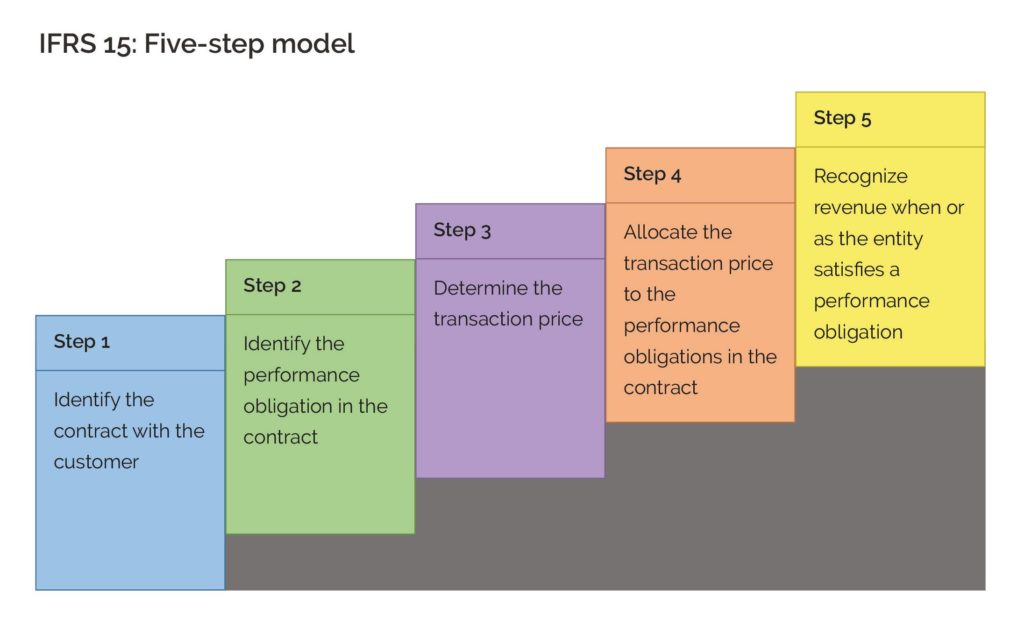

IFRS 15 moves away from the “transfer of risks and rewards” model of current standards and introduces a new five-step “transfer of control” model. Under the new standard, an entity satisfies a performance obligation by transferring control of a promised good or service to the customer. This can occur over time or at a point in time.

There was significant concern from industry and professionals about the expected impact of some components of the five-step model, primarily related to identifying performance obligations, licenses and intellectual property, agent vs principal considerations and timing of revenue recognition. In 2016, the IASB responded to these concerns by amending the new standard to clarify some of these concerns. The clarifications simply “clarify”, so the devil is still in the details, and businesses will need to dive deep to determine their entity specific impact of implementing the new standard. Missing or misinterpreting any of the new standard requirements, or any of its critical disclosure requirements will have significant consequences for businesses.

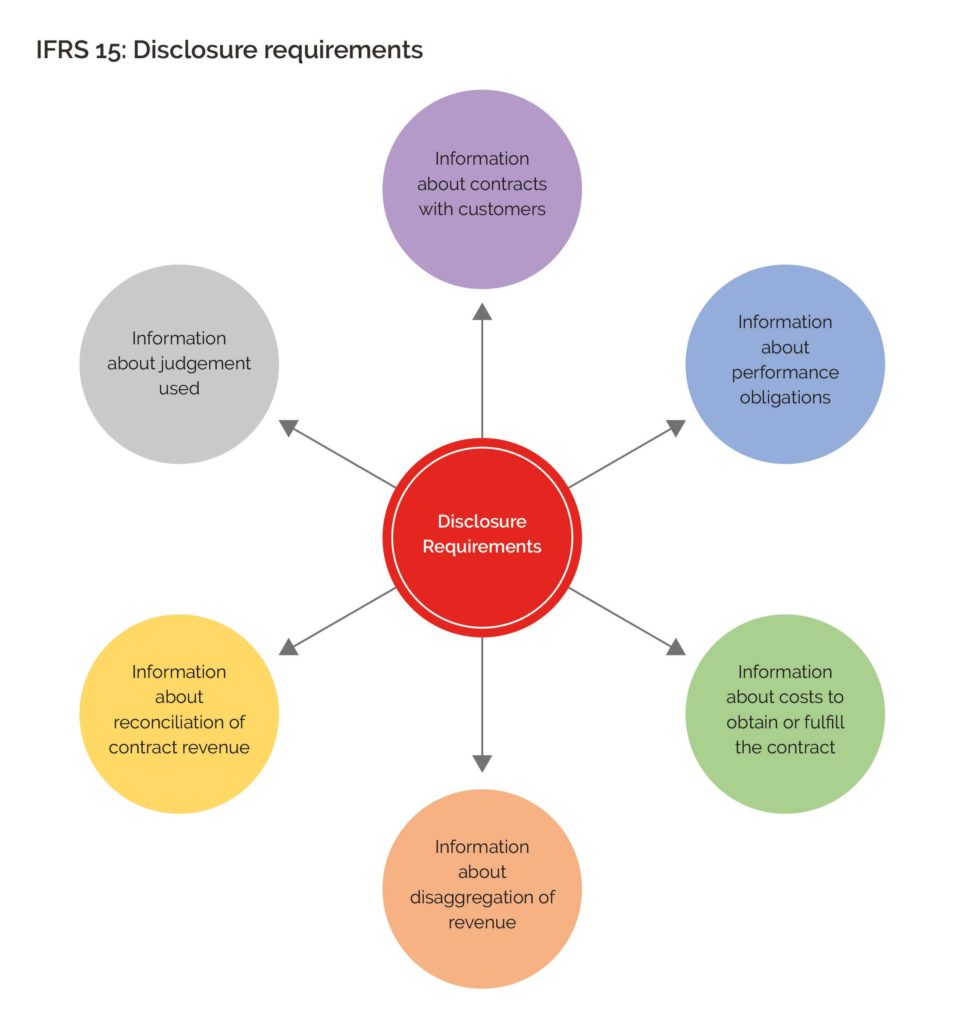

As relates to disclosure notes, IFRS 15’s objective is to provide users of financial statements with information that will help them to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. Businesses must clearly disclose any significant judgements made by management in applying IFRS 15, including judgement on decisions about assets recognized in relation to obtaining or fulfilling a contract. This means that the traditional check list approach to disclosures will not be enough to meet IFRS 15 disclosure requirements. Rather, businesses should consider diligently how to provide both quantitative and qualitative disclosures around their contracts with customers.Businesses will need to take proper steps to ensure that the business’ information systems are updated accordingly to capture, process and report the required information and disclosures.

Revenue is a central and critical part of any business, consequently any changes to the way revenue is recognized will impact almost all significant areas of the business from sales processes to information systems. An effective implementation plan requires the involvement of stakeholders from all areas of the business that will be significantly impacted by the new standard. As indicated above, the devil is in the details, it is only when management dives deep into the implementation process that they will have a good understanding of the entity specific impact of the new standard.

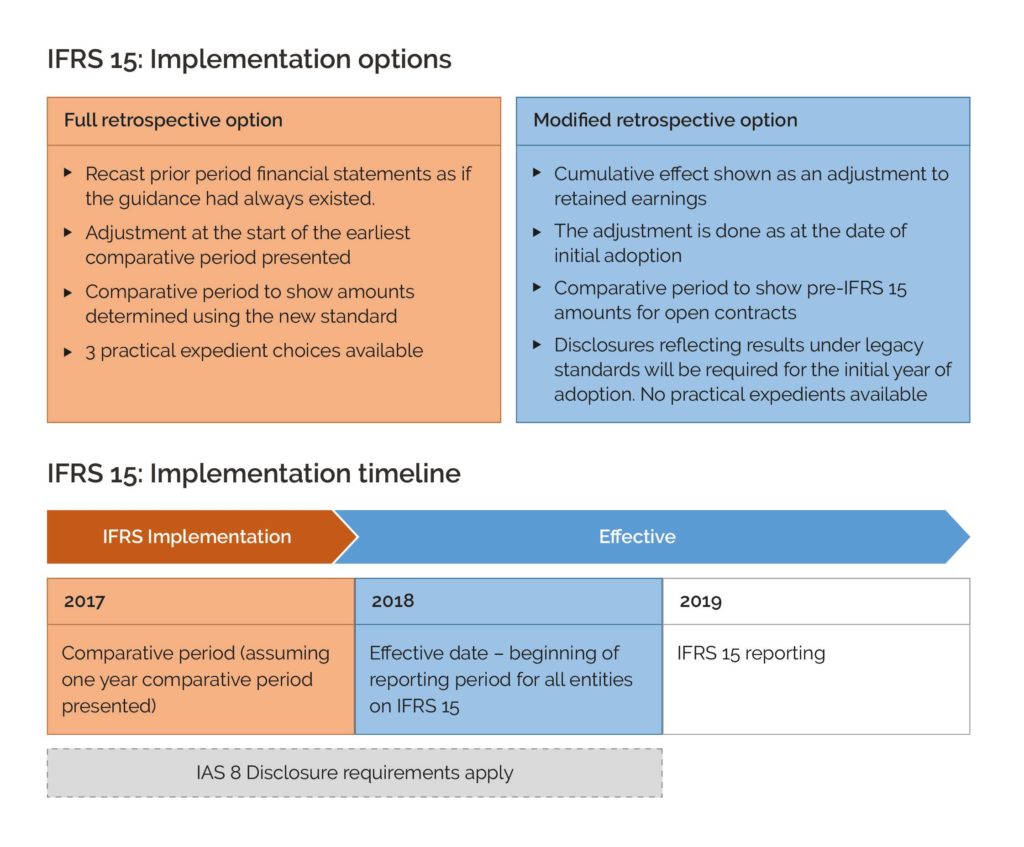

Most business, both public and private, will implement the full retrospective option simply because most of their stakeholders will require full retrospective application. While at first glance the modified retrospective option seems to suggest a reduced effort in implementation, business will need to dive deep to determine which implementation option is most suited for its specific situation.

Regardless of which implementation option is selected, businesses will go through some form of parallel reporting, where accounting records are maintained under both the current standard and the new IFRS 15 standard during some phases of the implementation timeline. This will compound pressure on resources and systems required to deliver an effective implementation of the new standard.

Implementing the new standard will be a significant project and will require a strong team to see it through. Most businesses will need to strengthen their internal teams with outside experts to deliver an effective implementation of the standard. As the effective date of January 1, 2018 gets closer there will be increased pressure and competing demands for both internal and external IFRS implementation experts. The best approach is to start now.

How we can help

Our team offers a broad range of experience and deep technical expertise in IFRS implementation and accounting solutions. Our professionals have been delivering world class IFRS implementations and advisory services since 2009 in Canada and around the world. We can help your business with planning, analysis, implementation, and ongoing support related to IFRS 15 and other unique accounting solutions that your business may need.

Howlite Consulting Inc.

www.howliteinc.com

info@howliteinc.com

+1 587 317 4481

Post a Comment:

You must Register or Login to post a comment.