Managing the impairment of business assets in today’s environment of rapidly changing markets, technology, and regulations, has become a very important part of the overall management of business assets. In simplified terms, impairment of long lived assets (items of property, plant and equipment) occurs when an asset or a group of assets is worth less than the value at which it is presented in the business’ Balance Sheet. The primary principle in IAS 36: Impairment of Assets, is that assets must be carried in a business’ financial statements at no more than the highest amount to be recovered through the use or sale of those assets. Under IAS 36, an asset is impaired if its carrying amount exceeds its recoverable amount. In the event of an impaired asset, an entity must recognize an impairment loss by reducing the carrying amount of the asset to its recoverable amount.

IAS 36 sets out the requirements and guidance on when entities need to perform impairment testing, how to perform the tests, how to recognize any resultant impairment losses, and how to make disclosures related to the impairment of assets. The impact of IAS 36 is wide and deep and cuts across business of all types across all industries. Leading entities have had to reassess and update their asset impairment testing processes, assumptions, and models to ensure compliance with IAS 36.

Scope of IAS 36

The following assets are excluded from the scope of IAS 36:

- Inventories (IAS 2)

- Assets arising from construction contracts (IAS 11)

- Deferred tax assets (IAS 12)

- Assets arising from employee benefits (IAS 19)

- Financial assets (IAS 39)

- Investment property carried at fair value (IAS 40)

- Agricultural assets carried at fair value (IAS 41)

- Insurance contract assets (IFRS 4)

- Non-current assets held for sale (IFRS 5)

Identifying Assets that may be Impaired

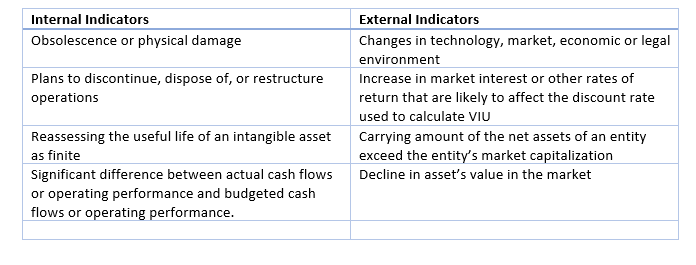

Under IAS 36, entities are required to assess, at each reporting period, whether there is an indication that an asset is impaired. While the standard provides some guidance on internal and external sources of information that may act as indicators of possible impairment, management must make significant judgement in the actual application of these indicators. Examples of internal and external indicators include:

If there is an indication that an asset may be impaired, the estimated recoverable amount is compared to the carrying amount at the end of the reporting period. An impairment loss exists where the carrying amount exceeds the recoverable amount. Goodwill, intangible assets with indefinite useful lives and tangible assets not yet available for use are tested at least annually for impairment.

Measuring the recoverable amount

The recoverable amount is the higher of an asset’s fair value less costs of disposal (FVLCD) and the asset’s value in use (VIU). Impairment is measured by comparing the asset’s carrying amount with its recoverable amount.

In determining FVLCD, fair value is the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date. Fair value is determined in accordance with IFRS 13, if there is no active market for the asset being valued, the entity should select the technique (e.g. discounted cash flows) that is most appropriate for the asset being valued. Costs of disposal are incremental costs directly attributable to the disposal of an asset, such as legal costs etc.

VIU is the present value of the future cash flows expected to be derived from an asset or CGU. VIU reflects factors that are specific to an entity, and is therefore different from a market based fair value measurement.

FVLCD and VIU models should reflect risk and uncertainty to the extent that such risk and uncertainty would be reflected in the price of an arm’s length transaction.

Cash Generating Units (CGUs) and Goodwill

Where possible, the recoverable amount should be determined for each individual asset. However, where this is not possible, the recoverable amount should be determined at the Cash Generating Unit level. IAS 36 defines a Cash Generating Unit as the smallest identifiable group of assets that generate cash flows that are largely independent of the cash flows from other assets or groups of assets. While the standard provides detailed guidance on how to identify CGUs, in practical application, management will need to exercise significant judgement in identifying the entity’s CGUs.

For the purposes of impairment testing, goodwill acquired in a business combination must be allocated to a GCU or a group of GCUs at acquisition date. Goodwill is tested for impairment at the lowest level at which goodwill is monitored within the entity, which may be at the CGU level, however this level cannot be larger than an operating segment. Goodwill, intangible assets with indefinite useful lives and tangible assets not yet available for use must be tested for impairment at least annually. Impairment testing is done by comparing the carrying amounts of these assets with their recoverable amounts, irrespective of whether there is an indication of impairment.

Recognition of an impairment loss

An impairment loss is recognized whenever an asset’s recoverable amount is less than its carrying amount. For assets that are carried at historic cost, the impairment loss is recognized as an expense immediately in profit or loss. If the impaired asset is a revalued asset, the impairment loss is treated as a revaluation decrease and recognized in other comprehensive income, reducing the revaluation surplus for that asset. In recognizing an impairment loss, the carrying amount of the asset can never be reduced below zero. The standard states that after the recognition of an impairment loss, the depreciation charge for the asset shall be adjusted in future periods to allocate the asset’s revised carrying amount, less its residual value, on a systematic basis over its remaining useful life.

Reversal of impairment loss

At the end of each reporting period, an entity must assess internal and external sources of information to determine if there have been significant favorable changes in the asset’s value and market conditions. An impairment loss is reversed if there has been a favorable change in the estimates used to determine the recoverable amount of the asset or CGU. When an impairment reversal is recognized, the adjusted carrying amount should not exceed the carrying amount of the asset that would have been determined had no impairment loss been previously recognized.

Disclosure requirements

IAS 36 has significant disclosure requirements in respect to impairment tests performed and impairments recognized under the standard. Disclosure requirements include:

- Amounts of impairments recognized and/or reversed including events and circumstances that caused the impairment or reversal.

- Amount of goodwill per GCU or group of CGUs

- Valuation method applied for FVLCD or VIU and its approach in determining the appropriate assumptions.

- Key assumptions used in the valuation model including growth rates and discount rates used.

- Sensitivity analysis, when a reasonably possible change in a key assumption would result in an impairment, including and “accommodation” in the impairment model and the amount by which the assumption would need to change to result in an impairment.

How we can help

Our team offers a broad range of experience and deep technical expertise in IFRS implementation and accounting solutions. Our professionals have been delivering world class IFRS implementations and advisory services since 2009 in Canada and around the world. We can help your business with planning, analysis, implementation, and ongoing support related to IAS 36: Impairment of Assets and other unique accounting solutions that your business may need.

Howlite Consulting Inc.

www.howliteinc.com

+1 587 317 4481

Post a Comment:

You must Register or Login to post a comment.